What is the current condition of the U.S. economy?

Record low unemployment, an ongoing trade war, a turbulent stock market and a world leader in gross domestic product (GDP) are the characteristics of the current U.S. economy.

By the numbers: The unemployment rate, which only accounts for jobless individuals who are actively seeking work, dropped to 3.5% as of September 2019, a 50-year low.

The Dow Jones industrial average, which is a holistic measurement of stock performances of 30 large companies, rose to an all-time high in July 2019, breaking 27,000.

The U.S. GDP, which measures the total monetary value of production within a country’s borders, is roughly $20 trillion.

While these measurements often point to a healthy economy, many experts believe a recession is looming in the near future.

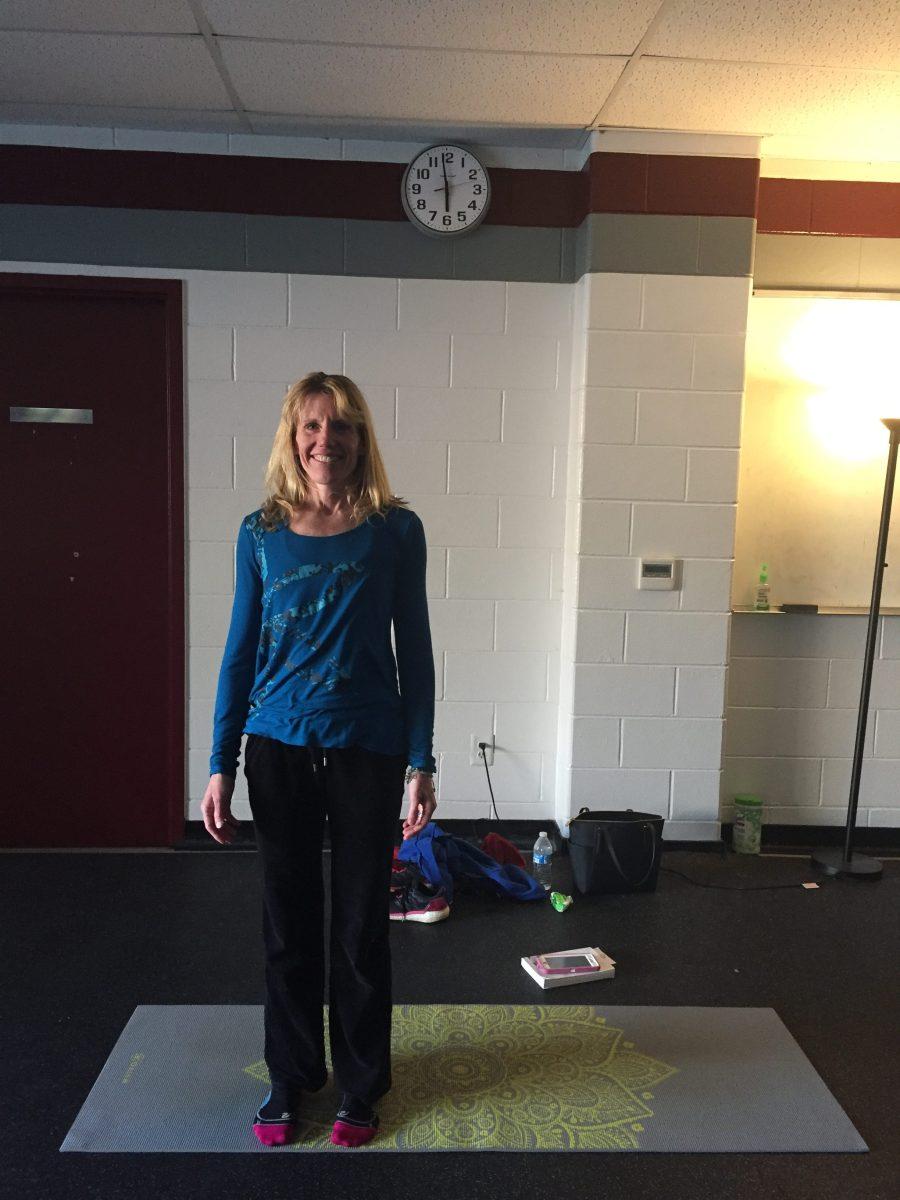

“It’s been 10 years since the last recession, and things tend to go in cycles,” said Karen Hogan, Ph.D., professor of finance. “It’s not going to be a meltdown, I don’t think, but there have definitely been better markets than what we have right now.”

A recession is marked by a strong decline in overall economic activity, which usually lasts for at least a few months. Essentially, businesses will cease investments, people will be laid off work, and consumers will likely cut back on spending.

Why do experts believe an economic down turn is looming?

“To me the biggest one is the inverted yield curve and not just for one quarter, but for multiple quarters in a row,” Hogan said.

The yield curve refers to returns on U.S. treasury bonds over various periods of time. Typically, long-term treasury bonds come with higher yields (higher returns) than short-term bonds, because an investor’s money is tied up longer, so they expect a higher return.

If investors lose confidence in the short-term economy, they will begin to invest their money into long-term bonds, forcing the U.S. treasury to increase the yield on short-term bonds to attract investors. When short-term bonds have higher yields than long-term bonds, an inverted yield curve occurs.

“Usually yield curves have been a pretty good forecast in terms of recessions,” Hogan said.

Yield curves have preceded and predicted recessions in 1981, 1991, 2001 and the 2008 mortgage default crisis. Furthermore, a trade war with China may only aggravate the situation.

“I have a friend who builds equipment that musicians use, and it’s all made out of steel, and he now has to buy his steel in the U.S. because when you try to purchase steel that has a tariff on it, it’s not the foreign company that pays, it’s the home country, it’s the person who’s buying it,” Hogan said.

The current interest rate may also aggravate the situation even further. During times of economic down swings, the federal reserve will decrease the interest rate, so people are more enticed to invest, which helps revitalize the economy.

“Interest rates are low, so there’s not a whole lot of stimulation that you’re going to be able to do to reduce interest rates,” Hogan said. “That’s a little worrisome.”

How would an economic down turn affect higher education?

Higher education is not immune to economic down turns. Anything from enrollment in certain majors to the amount of money colleges and universities receive through government funding could be affected.

There’s a ripple effect, according to Nancy Fox, Ph.D., associate professor of economics, who also served as associate dean for over 11 years. For example, at St. Joe’s, the number of business majors goes down when the economy improves. That affects the number of students in introductory economics courses, which also goes down, she explained.

“It’s countercyclical,” Fox said.

Aside from enrollment in certain majors, government funding of universities could also be affected if the economy falters.

“If the economy is strong, there’s more tax revenues,” Fox said. “The government has more money to spend, so it could spend it in higher education.”

Although higher education may see a decrease in funding if the economy enters a recession, graduate higher education will likely fare better than undergraduate higher education, because more students enroll in graduate school during a down-turn in the economy.

Daniel McCann ’09, J.D., adjunct professor of economics, graduated from St. Joe’s with a degree in economics at the end of the 2008 recession. His choices? Get a job or go to law school. He chose law school.

“There is a theory in economics called ‘opportunity costs,’” McCann said. “Essentially, opportunity cost is whatever you gave up in making a decision. It is the other option. In 2009, attending graduate school had a low opportunity cost because the job market was not strong in most fields, so not taking that first job out of college was not as costly (financially) as it would be in a very strong job market.”

If experts correctly predict a recession, soon-to-be graduates will be faced with fewer jobs.

“I say to the students who are graduating this year, be thankful you’re graduating this year because I think next year is going to be harder to get a job,” Hogan said.

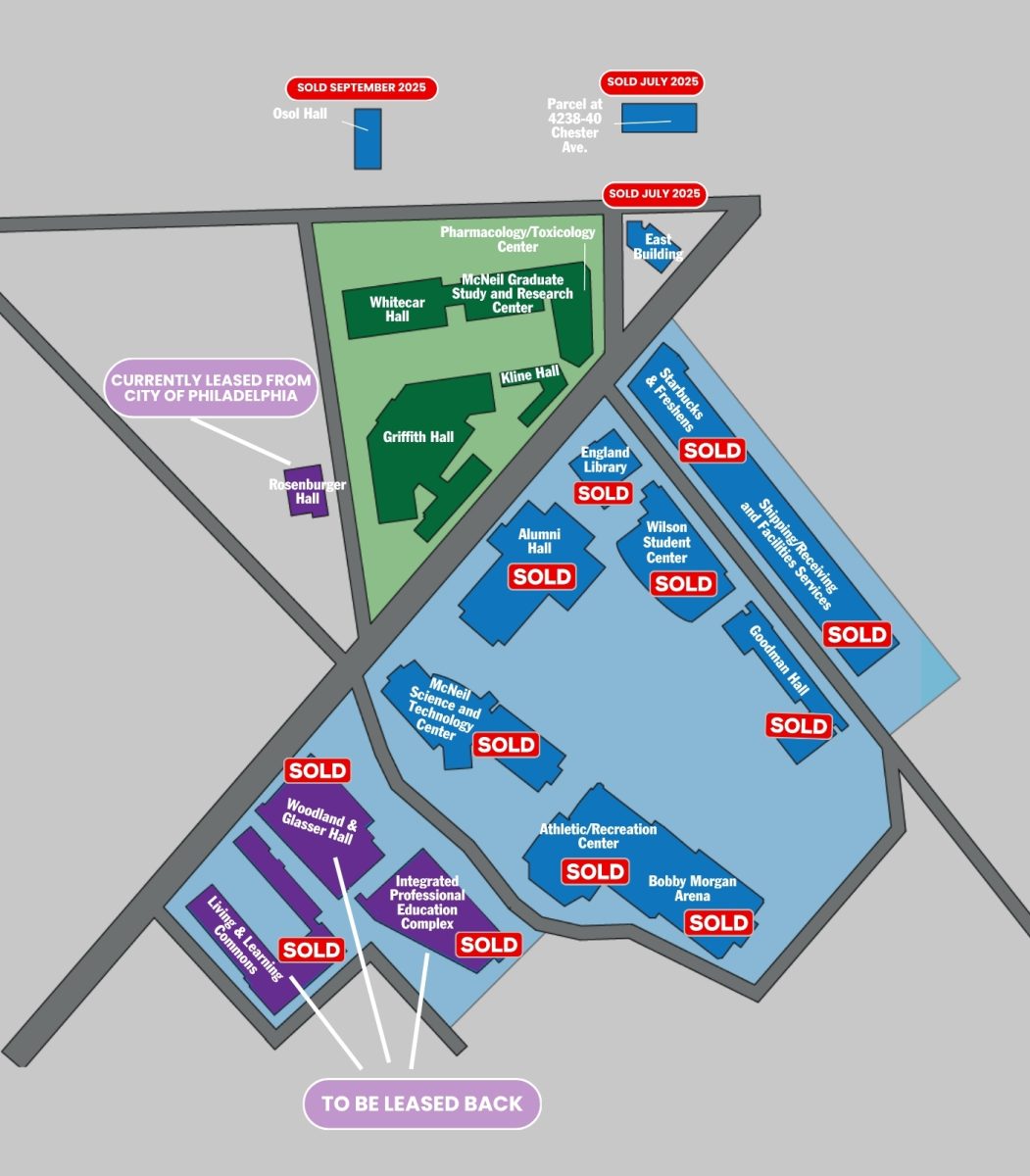

How might St. Joe’s fare in a struggling economy?

St. Joe’s survived the last recession, but the effects of that recession were definitely felt at the university, Fox said, who was assistant dean of the College of Arts and Sciences (CAS) during the 2008 recession.

“We had so many financial aid issues,” Fox said. “Students needed more, they dropped out, they worked more.”

Over 10 years later, many private colleges and universities continue to face financial difficulties, that may be compounded by an economic down period.

“No question, there will be more people who will need financial aid, and how will that affect private colleges with hefty price tags?” Fox asked. “That’s going to affect the St. Joe’s. That’s not going to affect the Princetons.”

Princeton’s endowment is roughly $26 billion, as compared to the $305 million endowment of St. Joe’s. Private universities with enormous endowments – such as Princeton – will be in a better financial position should the economy falter, Fox explained.