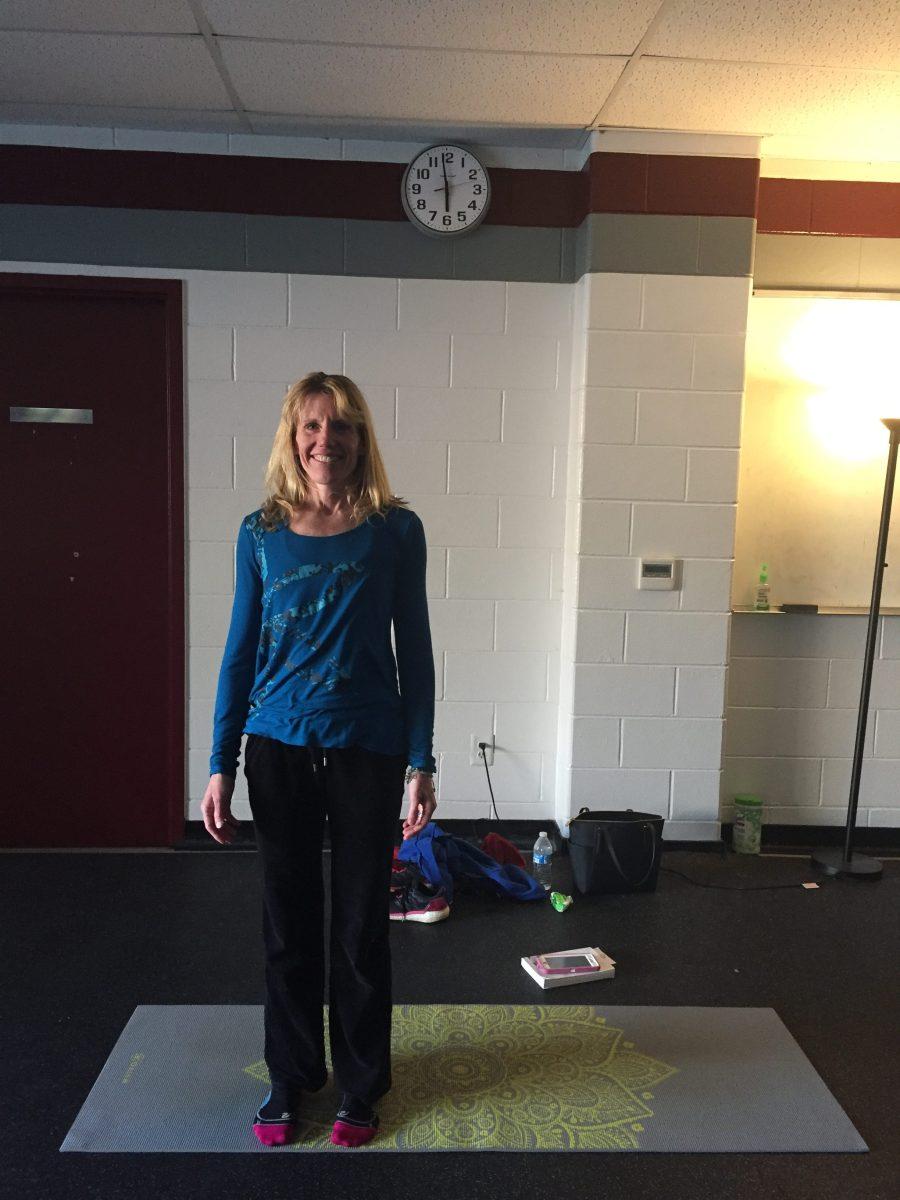

The Office of Financial Aid hosted a workshop to help students understand their FICO scores on Nov. 6 in Doyle Banquet Hall.

Elizabeth A. Rihl Lewinsky, director of financial aid, said it is important for students to be financially literate so they understand the positive and negative repercussions FICO scores, a summary of individual credit reports, on their professional future.

“Students need to feel empowered to be able to manage their personal finances,” Lewinsky said. “They need to know how to know the basics of credit, how to maintain good credit, how to create a budget, and to be able to differentiate different types of accounts.”

Lewinsky began the presentation by highlighting the importance of understanding the three c’s of credit — character, capital and capacity. Character is how well you handle financial obligations, capital represents the assets you own, including real estate, savings and investments, and capacity is how much debt can you manage.

Lewinsky said a person’s FICO score represents the assessment of one’s credit-worthiness.

“You will have a better interest rate if you have a good FICO score,” Lewinsky said. “It can help you save so much money when applying for a mortgage loan if you have a good score.”

The FICO score, created by the data analytics company, the Fair Isaac Corporation, determines an individual’s score by factoring their on-time payment history, how much credit they’re using, their credit history, new credit and the different types of credit.

According to Lewinsky, employers hiring or interviewing job applicants are not only wanting to see the applicants’ GPA and academic success, but are also starting to request access to the applicants’ FICO scores.

“Most jobs look at all of your grades and accolades before they determine whether or not to hire you,” Lewinsky said. “But there are actually employers today that run your credit history in determining whether or not they want to hire you. It is beginning to become a very common theme, they want to know your financial health.”

Certain types of debt are viewed as good in the eyes of debtors, such as student loans, because they show evidence of a college education, which suggests an increase in potential lifetime earnings.

Matthew Medve ’22 said he saw the information presented at the workshop as very important for college students.

“I really do see this as a big topic for us because we typically don’t have classes covering these types of things,” Medve said. “Also most of us don’t have an unlimited amount of income because we don’t have actual jobs yet. So it is important for us to use it wisely.”

Lauren Bernic ’22 said she’s heard of the FICO credit score but didn’t know what it did or how it affected her.

“I’ve had a credit card that I’ve never used because I didn’t know the effects of taking credit,” Bernic said. “But now I think I have more confidence to use it and use it wisely.”

Lewinsky said there are many companies that offer options to find personal credit scores. These include companies like Experian and Credit Karma.

“Being financially literate allows [you] to make strong financial decisions, feel empowered about managing your personal finances and helps you to align your financial health with your long term goals,” Lewinsky said.