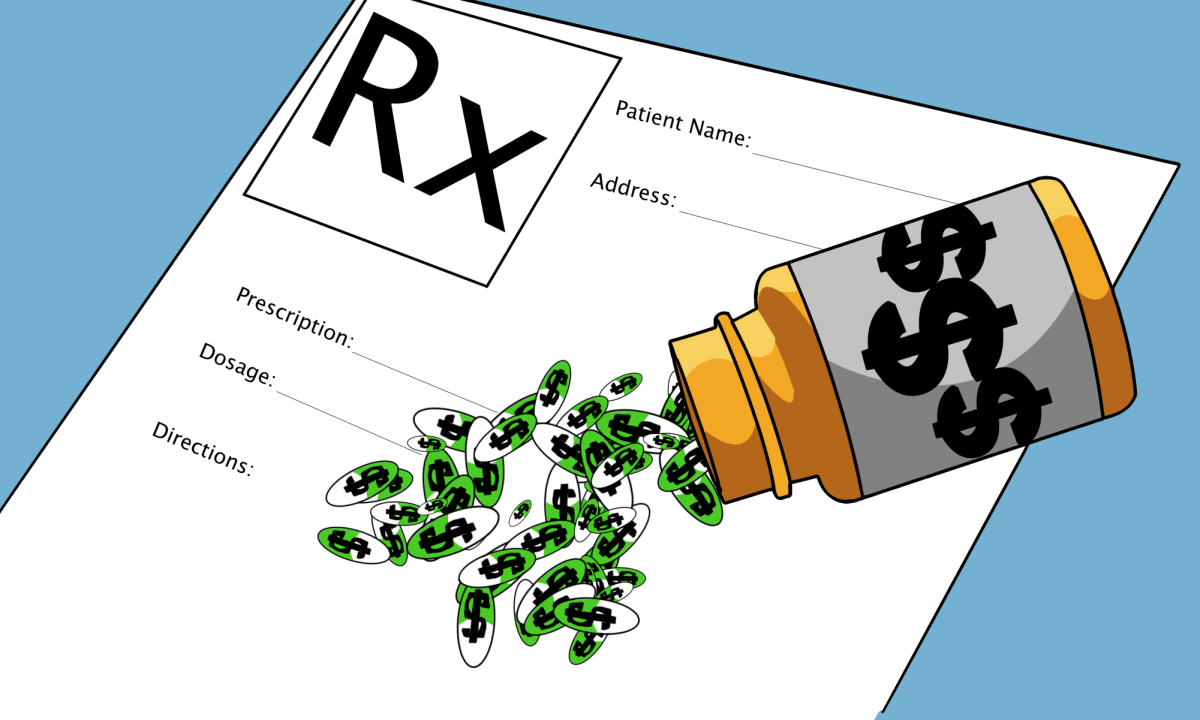

Students who are getting paid for jobs through Venmo, a popular mobile payment app, may need to pay federal taxes on those earnings starting in 2023.

On Jan. 1, as part of the 2021 American Rescue Plan Act, Venmo began reporting commercial transactions of more than $600 per year to the Internal Revenue Service (IRS). Commercial transactions are payments for goods or services.

The purpose of each Venmo transaction must be specified according to the company’s User Agreement, which reads “Payments for the sale of goods or services made using the Pay and Request feature in your Venmo account must either be identified as for goods and services or sent to business profiles.”

Before the tax code was changed in 2022, Venmo only reported commercial transactions to the IRS when they exceeded 200 transactions per year and were over $20,000, according to the IRS website. This new rule applies to 2022 earnings, meaning that it will affect tax filings in 2023.

Many St. Joe’s students use Venmo for a variety of transactions, from donating money to a campus organization’s fundraiser to splitting a bill when they go out to dinner with friends. Students who live off-campus also use Venmo to pay their rent. The new rule, which applies to any mobile payment app, like CashApp or PayPal, does not affect those non-commercial transactions.

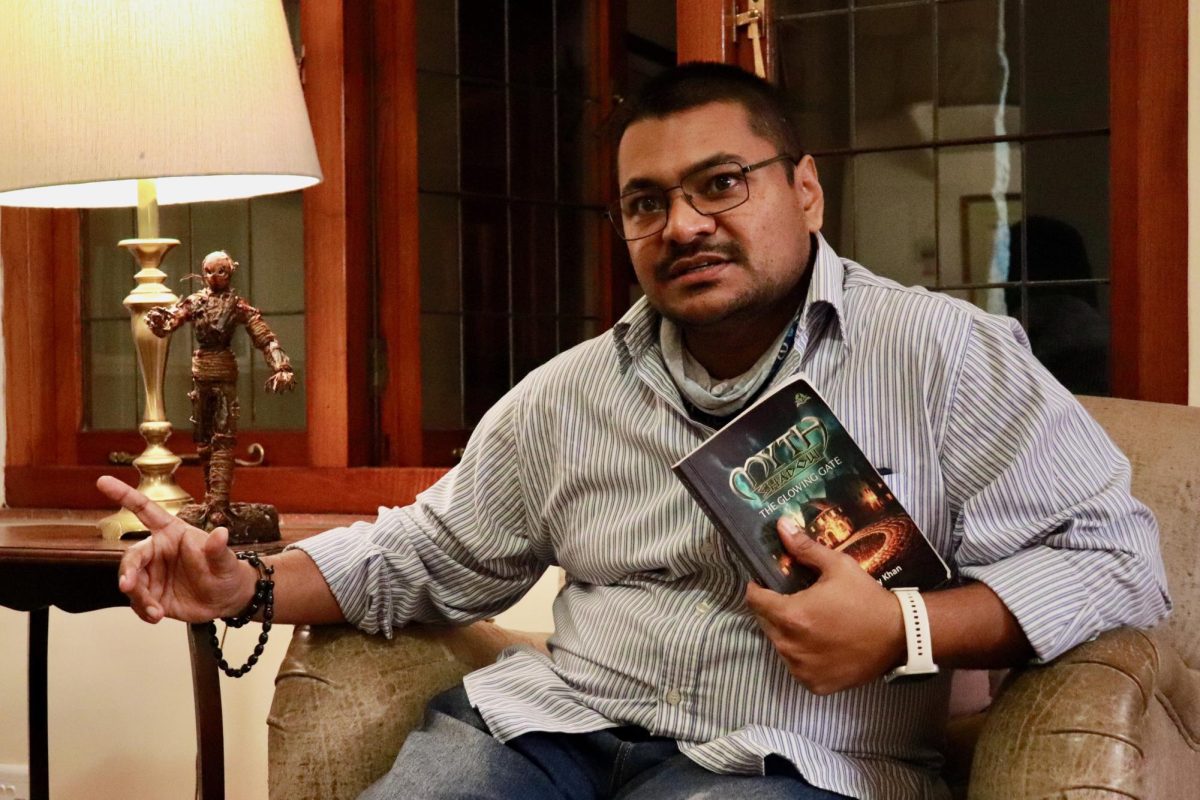

Venmo is going to report income and have people fill out a Form 1099-K if someone is receiving payments for goods and services, said A.J. Stagliano, Ph.D., professor of accounting.

A 1099-K is a tax form that reports payments that use a third-party network like Venmo, or that involve a credit, debit or other card transaction.

“That scares people,” Stagliano said. “The 1099-K reporting is relevant only if someone is selling goods and services, not splitting dinner bills, which is what Venmo was created for.”

Nicolette Senatore ’23 has an off-campus job babysitting for a family in Conshohocken, PA and is paid through Venmo. She has not exceeded the $600 limit and has not filled out a 1099-K yet, but she said she understands why it is necessary for Venmo to start reporting her income.

“I’m a business major,” Senatore said. “Venmo is a business at the end of the day. I understand them doing it, but I think people are going to start to get frustrated and not use Venmo as much as they were.”

Jenna Troyano ’23 also has an off-campus job, running errands for families in Lower Merion Township, PA. She said she has not exceeded the $600 limit and has not had to fill out a 1099-K yet, but knows she will probably have to in the future. Despite that, Troyano thinks the new rule is fair.

“It’s not really wrong,” Troyano said. “If somebody is bringing in a certain amount of money, it’s not fair to people who are bringing that in through other ways.”

Senatore said she “could see employers and employees getting frustrated” if taxing becomes a big issue when using Venmo. Then employers might stop using mobile payment apps and go back to writing checks.

According to the IRS the American Rescue Plan Act of 2021 only applies to commercial payments for goods and services, not charitable donations. This means that for campus clubs and organizations that use Venmo for fundraising, donations will not be taxed.

Troyano, a member of the Make a Wish Club and Alpha Phi, said these organizations use Venmo for fundraisers, but they have not been taxed because the system knows the transactions are donated.

“I think that is fair how they’re working,” Troyano said. “We haven’t gotten taxed, and I personally haven’t been taxed.”

As long as Venmo knows there is no reportable business income involved and the transaction is labeled as a “charitable donation” in the payment comment, then the system will not generate a 1099-K, Stagliano said.