Temporary aid to a growing crisis

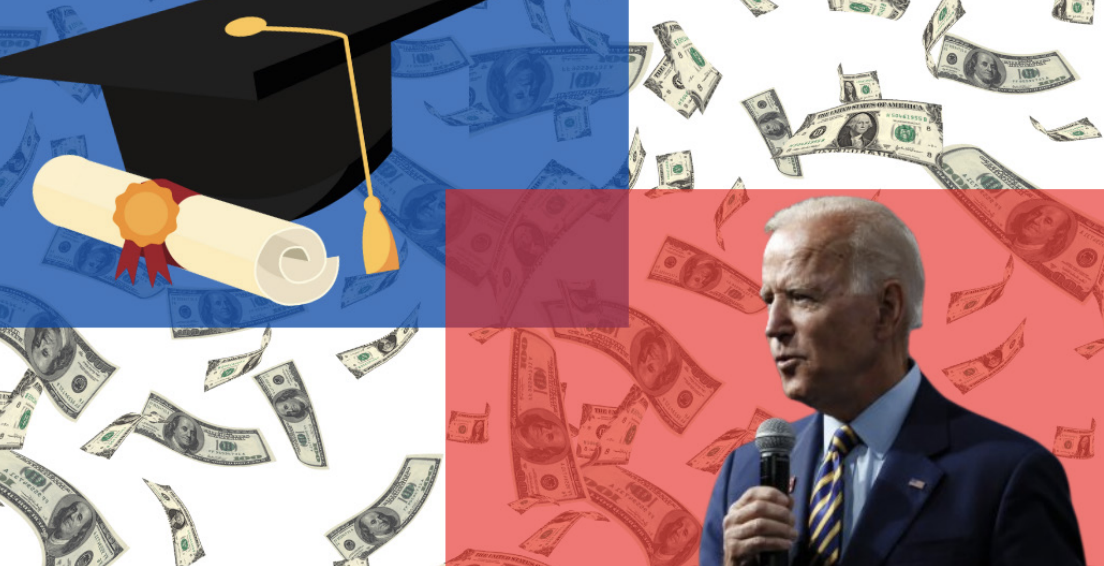

America does not have a student loan problem, it has a student loan crisis. Since 2007, student loan debt has increased 144% to around 1.7 trillion dollars. As the White House has claimed, this is mostly a result of the rising cost of college, with tuition (let alone housing and fees) nearly tripling across the country in the last 40 years. Yet, while the rising cost of college has been a problem for half a century, our government has turned this problem into a crisis.

President Obama (and Vice President Biden) first sought to tackle this issue in 2010 with the Health Care and Education Reconciliation Act. The bill introduced federal student loans through the Department of Education. According to MeasureOne, the federal government owns 92% of student loan debt. Yet, despite government action, the problem has only worsened year after year.

It was no surprise, then, that student loan forgiveness and reform was something President Biden campaigned on, but President Biden’s newly announced plan has left Americans with many questions. On Aug. 24, the White House announced a plan to cancel $10,000 of student loan debt for any American who makes less than $125,000 annually. Americans who received Pell Grants are eligible for loan forgiveness up to $20,000. While this seems like much needed relief for the some 45 million Americans with student loans, this proposal only pushes the problem further down the line by not addressing the root causes of the debt crisis.

In effect, the Biden administration is rewarding the same college system they accuse of jacking up prices by immediately using public funding to pay off these loans. Instead of needing to manage former students’ monthly loan payments, colleges are now poised to get hundreds of billions of dollars in just under a year. What ought to be a punishment is instead rewarding the same system that’s driving rising costs.

Most Republicans have gone beyond arguing specifics and instead are claiming that the very premise of college loan forgiveness is unfair. Senate Majority Leader Mitch McConell responded to the announcement in August saying, “President Biden’s student loan socialism is a slap in the face to every family who sacrificed to save for college … President Biden’s inflation is crushing working families, and his answer is to give away even more government money to elites with higher salaries.”

This echoes concerns from many Americans who simply don’t think college students deserve debt forgiveness. After all, college graduates tend to earn the most after graduating, willingly choosing to take on this debt for their own education, and often come from the most privileged backgrounds in American society. Indeed the idea that college educated folks making six-figure salaries now qualify for government handouts is frankly ridiculous when so many Americans are struggling to get by.

Even many Democrats have criticized Biden’s plan, like Jason Furman, economic adviser to former President Obama. He claims the overall cost will likely be around 500 billion dollars, money the U.S. government does not have. Ironically the U.S. government will need to use deficit spending, and therefore take more loans of its own, to pay off these student loans. This is especially concerning considering the weakness of the U.S. economy at the moment. Republicans, and some Democrats like Sen. Joe Manchin, have also blamed government spending like this as causing and worsening inflation.

Yet perhaps the best summary of the issues of Biden’s plan have come from an unlikely source: Shark Tank star Kevin O’Leary. He reacted to rumors of the proposal back in June in a CNBC interview where he said: “How about the people who never had the opportunity to go to college? About 12% of the population has student debt; the other 88% have to pay for them? You’re telling these people that this is a big problem? Meanwhile you can’t fill up your car, chicken costs 40% more and this is at the top of the agenda for the President?” It’s never a good sign when a Canadian billionaire is more in touch with the concerns of working class Americans than the President of the United States. Even as a college student facing similar financial pressures, I just cannot see the logic of spending billions to prop up a failing system. We need real student loan reform, not this. So for that reason, I’m out.